Exploring the 50/30/20 Budget Rule for Financial Success

Managing personal finances can often be a challenging task, especially with so much confusing content out there with different budget rules. I always prefer really simple rules that are easy to understand and implement in our day-to-day busy lives. With the right budgeting strategy, you can take control of your money and pave the way for financial success.

One popular and effective approach is the 50/30/20 budget rule, which offers a simple yet comprehensive way to allocate your income. In this article, we will delve into the details of the 50/30/20 budget rule, explaining its concept, benefits, and how you can apply it to your own financial situation. By the end, you will have the knowledge and tools to make informed decisions, optimize your spending, and achieve your financial goals.

Understanding the 50/30/20 Budget Rule

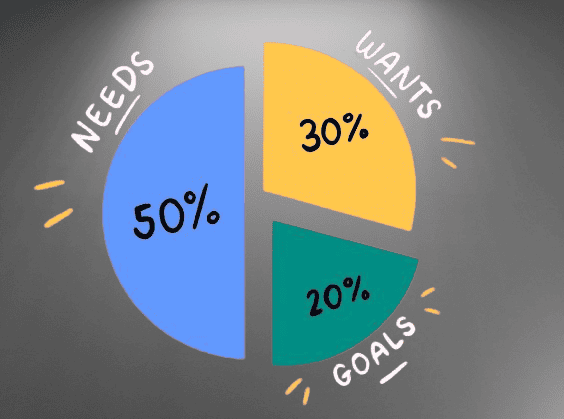

The 50/30/20 budget rule is a widely recognized method that divides your after-tax income into three main categories: needs, wants, and savings. It provides a balanced distribution of your finances while allowing flexibility for personal preferences.

a) Needs (50%): The first category focuses on essential expenses that are necessary for your basic needs and maintaining a decent standard of living. These include housing costs (rent/mortgage), utilities, transportation, groceries, healthcare, insurance premiums, and minimum debt payments.

b) Wants (30%): The second category covers discretionary spending on non-essential items and experiences that enhance your quality of life. This portion of your budget allows you to enjoy and indulge in things that bring you joy, such as dining out, entertainment, travel, hobbies, and subscriptions.

c) Savings (20%): The third category emphasizes the importance of saving and building a strong financial foundation. Allocating 20% of your income toward savings ensures you have funds for emergencies, future goals, and long-term financial security. This portion should be dedicated to emergency funds, retirement savings, debt repayment, investments, Sinking fund categories, and other financial objectives.

Now that we have a clear understanding of the 50/30/20 budget rule, let’s explore how to apply it effectively to your own financial situation:

a) Calculate your after-tax income: Start by determining your monthly income after deducting taxes. This will serve as the foundation for your budget allocation.

b) Assess your needs: Take stock of your essential expenses by listing them out and assigning them a percentage of your income. These may include rent/mortgage payments, utilities, transportation costs, groceries, insurance, healthcare, and minimum debt payments. Be sure to consider any fluctuating expenses, such as variable utility bills or irregular healthcare costs.

c) Allocate for wants: Dedicate 30% of your income to discretionary spending. This category allows you to enjoy life’s pleasures and engage in activities that bring you happiness. It covers expenses like dining out, entertainment, travel, hobbies, subscriptions, and personal treats. However, it’s important to exercise discipline and ensure that your wants fall within this allocated percentage.

50/30/20 Budget Calculator

Results:

50% for Needs: $

30% for Wants: $

20% for Savings: $

d) Prioritize savings: Set aside 20% of your income for savings and investments. This category plays a vital role in securing your financial future. Create an emergency fund to cover unexpected expenses, contribute to your retirement account, pay off any outstanding debts, create sinking fund categories for your future goals, and explore investment opportunities to grow your wealth. Make saving a priority by automating transfers to your savings account or retirement fund.

e) Track and adjust: Do not skip this step, this is where you improve and optimize the 50/30/20 budget rule. Regularly monitor your spending and compare it with your allocated budget. This will help you identify areas where you can cut back or optimize your expenses. Utilize budgeting tools or apps to simplify this process and gain better insights into your financial habits. Adjust your budget as necessary to accommodate changing circumstances or financial goals.

f) Embrace frugality and seek savings opportunities: Look for ways to reduce expenses in all categories, especially in needs and wants. Shop around for better insurance rates, compare utility providers, cook meals at home, explore free or low-cost entertainment options, and search for discounts or promotions before making discretionary purchases. Small changes can add up to significant savings over time.

Benefits of the 50/30/20 Budget Rule

The 50/30/20 budget rule offers several benefits that contribute to financial stability and peace of mind:

a) Simplicity: The rule’s straightforward approach makes it easy to understand and implement, even for individuals new to budgeting. Its simplicity allows for efficient tracking and adjustments, reducing the chances of overspending or neglecting savings.

b) Flexibility: Unlike strict budgeting methods, the 50/30/20 rule allows room for personal preferences and individual financial circumstances. It recognizes that everyone has different needs and desires, enabling you to customize your spending while maintaining a balance.

c) Financial security: By prioritizing savings, this budgeting rule helps build an emergency fund and secure your financial future. It encourages responsible spending and savings habits, protecting you from unexpected financial hardships and reducing reliance on credit.

d) Goal-oriented: The 50/30/20 rule facilitates progress towards long-term financial goals, such as debt repayment, homeownership, education, retirement, or starting a business. It encourages conscious spending and saving decisions, fostering discipline and determination. Regularly reviewing your budget can help you stay on track and make adjustments as your goals evolve.

e) Reduced financial stress: Having a well-structured budget alleviates financial stress and anxiety. Knowing that your essential needs are covered, you have room for discretionary spending, and you’re actively saving for the future brings a sense of financial security and peace of mind.

f) Improved financial decision-making: By adopting the 50/30/20 budget rule, you become more aware of your financial situation and gain a clearer understanding of where your money is going. This awareness enables you to make informed decisions about your spending habits, identify areas of improvement, and make strategic choices aligned with your financial goals.

Conclusion

In a world where financial stability is paramount, the 50/30/20 budget rule offers a practical and effective way to manage your money. By allocating your income into needs, wants, and savings, you can strike a balance between essential expenses, discretionary spending, and building a secure financial future. Implementing this rule not only provides clarity and control over your finances but also enables you to make informed decisions that align with your financial goals.

Remember, financial success is not about restriction but about finding the right balance. Embrace the 50/30/20 budget rule, and empower yourself to take charge of your financial journey, one step at a time. With diligent adherence to this budgeting principle, you can achieve financial stability, reduce stress, and pave the way for a brighter and more secure future.

Hi there! My name is Madhavi. Newgrowthzone is all about reaching your full potential. If you are interested in getting out of your comfort zone and reaching for your dreams, keep reading!